Over the last few years, crypto trading has transformed from a niche digital experiment into a global, competitive, and highly structured industry. Traders all over the world—from Europe to Africa, Asia to Latin America, the Middle East to Oceania—have turned crypto markets into 24/7 arenas of opportunity. But as the market matured, a new reality set in:

Trading capital determines how far skill alone can take you.

Even the most disciplined and talented trader can only do so much with a $300 personal account. Meanwhile, a funded account from one of the best crypto prop firms can unlock meaningful returns without risking personal savings. This is exactly why crypto prop trading firms have exploded in popularity—and why traders everywhere now search for the best crypto prop firm that fits their strategy.

At the same time, traders have begun paying closer attention to trading pair performance. Not all pairs behave equally, and some prop firms offer better market conditions on BTC pairs, ETH pairs, altcoin pairs, or even synthetic representations. Understanding pair behavior has become a competitive edge—especially for traders operating funded accounts with strict risk limits.

This long-form guest post will explore:

- What crypto prop trading firms are

- Why funded crypto trading has become a global revolution

- How to evaluate the best crypto prop firms in 2025

- Why trading pair comparisons matter

- How pair selection impacts consistency, drawdown, and evaluation success

- Why traders use independent platforms like cryptofundtrader.com

- How the comparison tool at cryptofundtrader.com/best-crypto-prop-trading-firms-pairs-comparison/ helps traders choose better pairs and better firms

Let’s dive into how capital access + pair knowledge can dramatically improve trading performance.

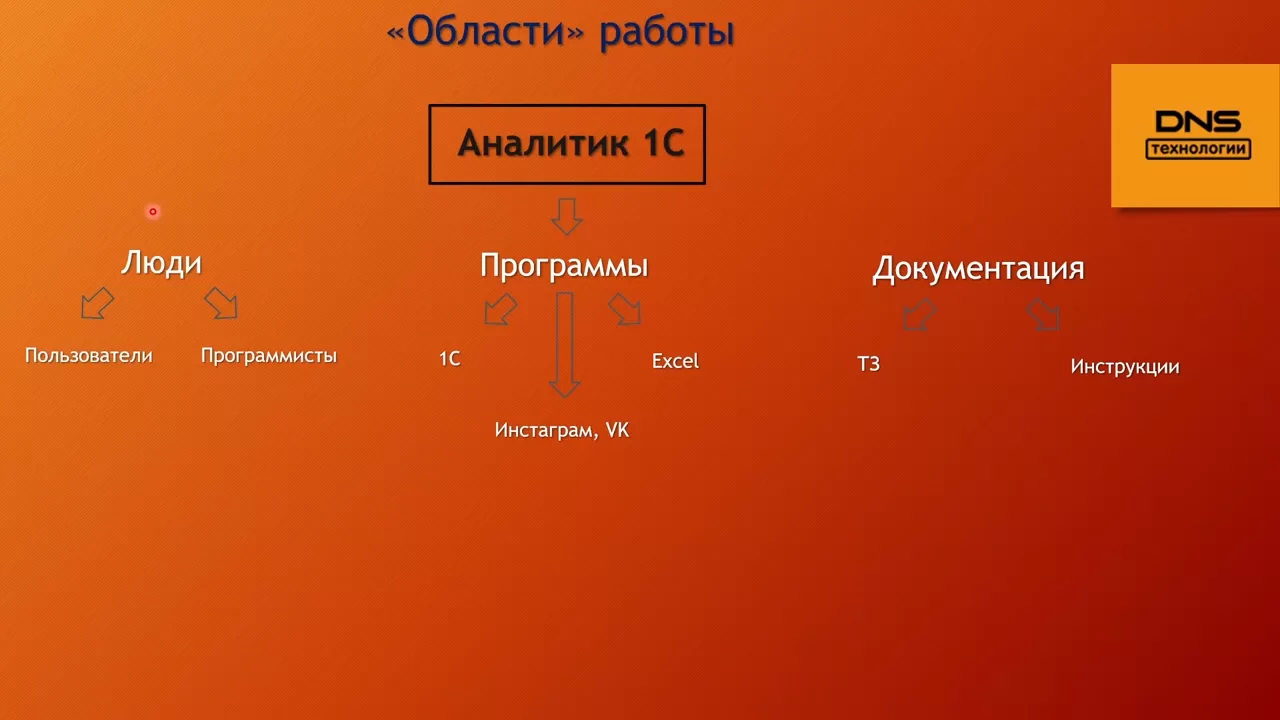

What Are Crypto Prop Trading Firms?

A crypto prop trading firm (proprietary trading firm) funds traders with company capital instead of requiring personal deposits. Traders pass an evaluation designed to test risk control and strategy discipline. Once they prove their ability to trade responsibly, they receive a funded account and keep a share of profits—often 80% to 90%.

This model has made professional trading accessible to tens of thousands of traders worldwide.

Crypto prop trading firms typically offer:

- evaluation challenges

- one-phase or two-phase funding models

- strict risk limits (daily drawdown, overall drawdown)

- capital accounts ranging from $10K to over $1M

- fast crypto-based payouts

- scaling plans for successful traders

The industry has matured so quickly that traders now compare dozens of options when looking for the best prop firm crypto programs.

Why Crypto Prop Firms Have Become a Global Movement

Three major forces are driving the worldwide shift toward prop-funded crypto trading:

1. Capital Access Without Personal Financial Risk

Nobody wants to risk their savings or hard-earned salary in a volatile market.

Crypto prop trading firms eliminate that need.

Instead of depositing thousands, traders simply pay for an evaluation, pass it, and receive access to:

- $25K

- $50K

- $100K

- $200K

- or even $500K+

This model democratizes trading opportunity.

2. Crypto Markets Run 24/7—Perfect for International Participation

Crypto’s nonstop trading hours allow traders in:

- Asia to catch early volatility

- Europe to trade overlapping sessions

- Africa to trade with flexible schedules

- LATAM traders to ride U.S. market flows

Because crypto never closes, funded accounts can be leveraged at any hour, creating global inclusion.

3. Prop Firm Rules Create Discipline and Consistency

Most traders fail because of:

- emotional entries

- oversized positions

- revenge trading

- no stop-loss

- lack of structure

Prop firms enforce rules that eliminate these behaviors.

This makes traders more consistent and improves long-term survival.

For this reason, many traders seek the best crypto prop firms not just for capital, but for structure.

Key Characteristics of the Best Crypto Prop Firm in 2025

Choosing the right firm makes the difference between long-term success and unnecessary frustration. Here are the critical factors traders look for when evaluating the best crypto prop firm options.

1. Fair and Transparent Rules

The best crypto prop firms provide:

- realistic profit targets (8–10%)

- logical drawdowns (5% daily, 10% overall)

- no hidden restrictions

- flexible trading styles (scalping, swing, bots)

Rule fairness is the foundation of trust.

2. High-Quality Trading Conditions

Execution quality has a major impact on:

- slippage

- spreads

- fill accuracy

- stop placement reliability

Traders often leave poor firms because execution destroys their edge.

3. Fast and Reliable Payouts

The best prop firm crypto companies offer:

- crypto-based payouts (USDT)

- processing times under 48 hours

- transparent profit splits

- reliable payment systems

Payout reliability is one of the strongest indicators of firm legitimacy.

4. Strategy Freedom and Flexibility

Great prop firms allow:

- algorithmic strategies

- manual price-action trading

- hedging

- news trading

- all major crypto pairs

Rigid firms hold traders back.

5. Strong Scaling Systems

The best crypto prop firms provide clear and achievable scaling pathways.

For example, doubling capital every:

- two payouts

- or consistent profitable months

Scaling is essential for building a professional trading career.

6. Good Reputation and Verified Trader Feedback

Traders rely on:

- real payout screenshots

- community feedback

- long-term credibility

- transparent communication

A firm’s reputation often determines whether traders trust it enough to commit.

Why Trading Pair Comparisons Matter in Prop Trading

Most traders compare firms based on rules, payouts, or pricing.

But one factor is just as important—and often overlooked:

Market pair performance.

Not every pair behaves the same way.

Even the best crypto prop firms offer different conditions depending on the pair.

Pair selection influences:

- trade volatility

- drawdown

- stop-loss efficiency

- win rate

- risk-to-reward

- evaluation success rate

For example:

BTC pairs

Often trend-clean, but volatile and prone to liquidation cascades.

ETH pairs

Smoother than BTC but still reactive to BTC dominance.

Altcoin pairs

High volatility; fast gains but fast losses.

Synthetic or FX-style crypto pairs

Easier structure but limited liquidity depending on platform.

Understanding these differences can drastically improve trader outcomes.

This is where the pair comparison resource at cryptofundtrader.com/best-crypto-prop-trading-firms-pairs-comparison/ becomes extremely valuable. Traders can see which firms offer the best conditions for specific assets—BTC, ETH, altcoins, and more—before choosing a firm.

How Pair Selection Impacts Evaluation Performance

When evaluating the best prop firms crypto, traders must consider which pairs give them the highest chance of passing and staying funded.

1. Volatility Control

Different pairs have dramatically different volatility profiles.

Selecting pairs that match your risk tolerance is essential for staying within prop firm drawdown limits.

2. Spread Efficiency

Some firms offer tight spreads on BTC but wide spreads on altcoins.

Wide spreads can ruin scalping strategies.

3. Liquidity and Slippage

The best crypto prop firms provide deep liquidity.

Poor liquidity causes:

- delayed fills

- slipped entries

- stop hunting

- unnecessary drawdown

This affects profitability massively.

4. Trend Structure

Some pairs trend beautifully.

Others chop sideways for days.

Choosing the right pair improves:

- trend-following success

- breakout trading

- price-action accuracy

5. Compatibility With Trading Style

Scalpers: need tight spreads and fast execution

Swing traders: need stable, directional pairs

Algo traders: need consistent volatility

News traders: need pairs that react cleanly

Pair selection determines a trader’s overall edge.

Why CryptoFundTrader.com Has Become a Trusted Resource

The prop trading industry is expanding quickly.

New firms appear monthly, and traders are overwhelmed with choices.

This is why many traders rely on cryptofundtrader.com, a platform that provides:

- detailed prop firm comparisons

- rule breakdowns

- payout reliability analysis

- strategy compatibility insights

- execution quality ratings

- pair comparison research

Instead of guessing which firm is best, traders can make decisions based on data—not marketing hype.

How Pair Comparison Tools Give Traders a Competitive Edge

The comparison tool at cryptofundtrader.com/best-crypto-prop-trading-firms-pairs-comparison/ shows traders:

- which pairs each firm supports

- which pairs have the best spreads

- which firms offer the best BTC conditions

- which firms offer the best ETH conditions

- how altcoin spreads differ

- which firms support leverage-friendly pairs

- which firms offer the most stable evaluation environments

This empowers traders to choose both the right firm and the right assets to trade.

The Future of Crypto Prop Firms (2025–2030 Outlook)

The next few years will dramatically reshape the prop trading world.

Here’s what to expect:

1. AI-Driven Evaluations

AI will monitor trader behavior patterns and optimize evaluation fairness.

2. More One-Step and Instant Funding Models

The industry will favor faster funding access and simpler rules.

3. Larger Capital Allocations

The best crypto prop firms may soon offer:

- $1M

- $2M

- $5M

accounts for elite performers.

4. Enhanced Crypto Pair Offerings

Firms will expand into:

- DeFi token pairs

- cross-chain assets

- synthetic crypto pairs

giving traders more opportunity.

5. Better Platform Liquidity

Partnerships with premium liquidity providers will reduce slippage globally.

Final Thoughts: The Best Crypto Prop Firms + The Best Trading Pairs = Maximum Trader Performance

Prop trading is no longer just a way to access capital—it has become the backbone of modern crypto trading careers. The combination of:

- choosing the best crypto prop firm

- trading pairs that match your strategy

- using reliable research tools

creates a massive advantage for traders who want consistent long-term success.

By understanding the structure, pair behavior, and platform quality of various crypto prop trading firms, traders can scale professionally and maximize profitability.

To evaluate firms effectively and compare trading pairs, traders rely on:

- cryptofundtrader.com for firm comparisons

- cryptofundtrader.com/best-crypto-prop-trading-firms-pairs-comparison/ for pair-based analysis

Together, these insights empower traders to choose wisely—and trade confidently—in a rapidly evolving industry.