Money is the lifeblood of modern economies, but have you ever wondered where it truly comes from? While governments print physical currency, most of the money circulating in our financial system is actually created in an entirely different way—by banks. This process, often described as “money creation out of thin air,” has profound effects on our economy, inflation, and personal debt. Let’s dive into the mechanics of how banks create money and the implications of this system.

Where Does Money Really Come From?

Every day, government facilities like the U.S. Bureau of Engraving and Printing churn out hundreds of millions of dollars in physical cash. However, this is just a fraction of the total money supply. The vast majority of money—over 97% in modern economies—exists digitally. Instead of being physically printed, this money is created through a process controlled by banks, central banks, and financial institutions.

To understand this system, we need to step back and look at the origins of money and the invention of banking.

A Brief History of Money and Banking

Centuries ago, trade relied on bartering—exchanging goods and services directly. However, this system was inefficient, leading societies to adopt metal coins, and later, paper money backed by gold reserves.

During the 17th century in London, goldsmiths played a pivotal role in shaping modern banking. They would store people’s gold and issue paper receipts as proof of ownership. Over time, people began using these receipts as currency, rather than withdrawing the actual gold. Goldsmiths realized that not everyone came to claim their deposits at the same time, so they started issuing more receipts (loans) than the gold they physically held. This marked the birth of fractional reserve banking—the foundation of our modern financial system.

How Banks Create Money from Nothing

Banks don’t just store money; they create it. Here’s how:

- Deposits as a Base for Loans: When you deposit money in a bank, you might assume it sits in a vault until you withdraw it. In reality, banks use most of your deposit to issue loans while keeping only a small fraction as reserves.

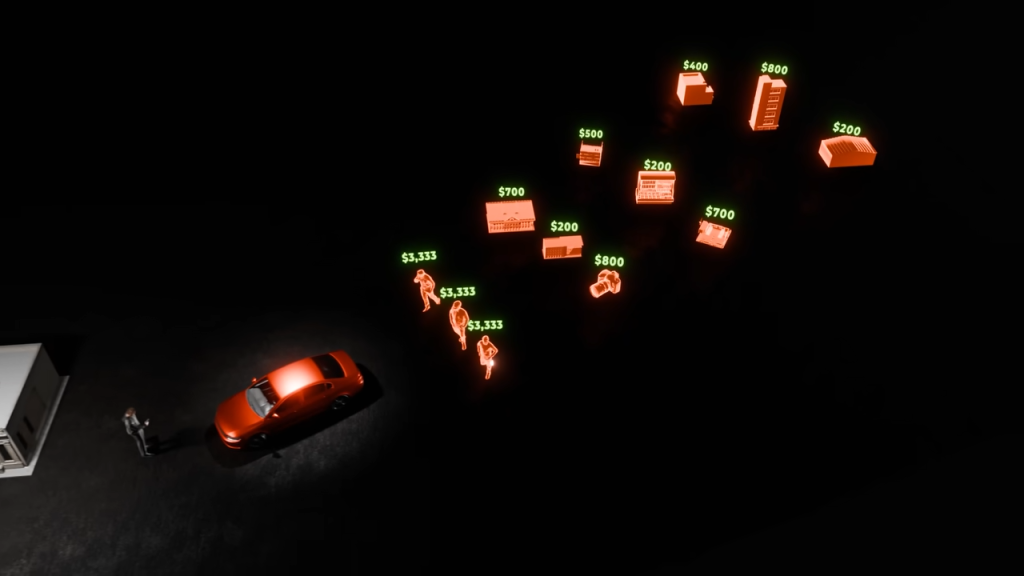

- The Loan Multiplier Effect: Imagine you deposit $1,000 into a bank. The bank is required to keep only a fraction of that amount (say 10%) as reserves. It can then lend out the remaining $900 to another customer. That customer spends the $900, which eventually gets deposited into another bank, where 90% of it can be loaned out again. This process repeats multiple times, exponentially increasing the money supply.

- Digital Money Expansion: Unlike physical cash, digital money has no inherent limit. When banks issue loans, they essentially type new money into existence. This money did not exist before the loan was granted, but now it enters circulation, driving economic activity.

Debt, Inflation, and the Risks of Money Creation

While money creation fuels economic growth, it also comes with significant risks:

- Inflation: When too much money enters the economy without a corresponding increase in goods and services, prices rise. This reduces purchasing power and can destabilize economies.

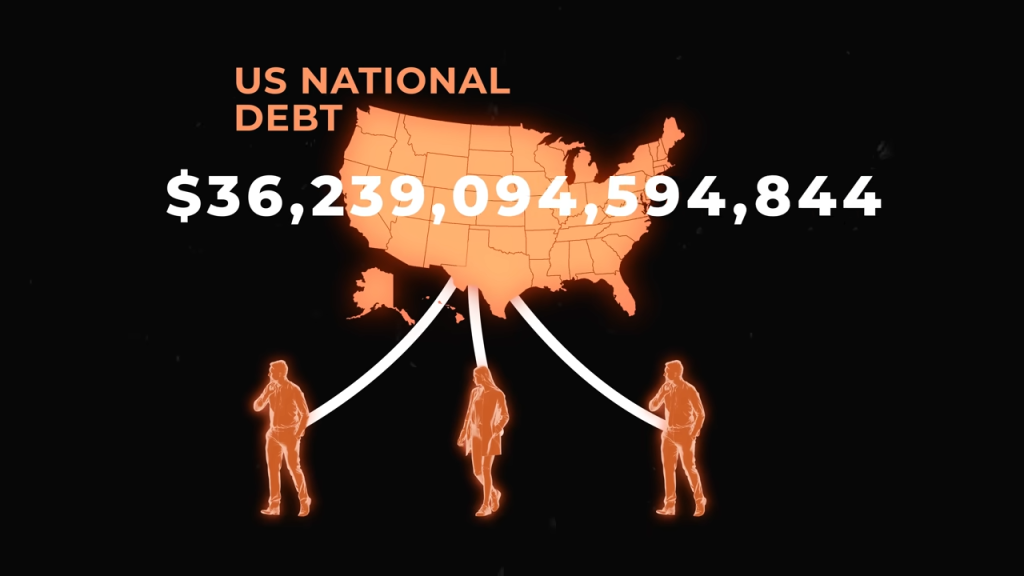

- Debt Expansion: Since money is largely created through loans, debt levels across households, businesses, and governments continuously rise. This can lead to financial crises if borrowers are unable to repay their loans.

- Bank Runs and Financial Instability: Because banks lend out most of their deposits, if too many people demand their money at once (as seen in bank runs), the system can collapse. Central banks often intervene to prevent this by providing liquidity.

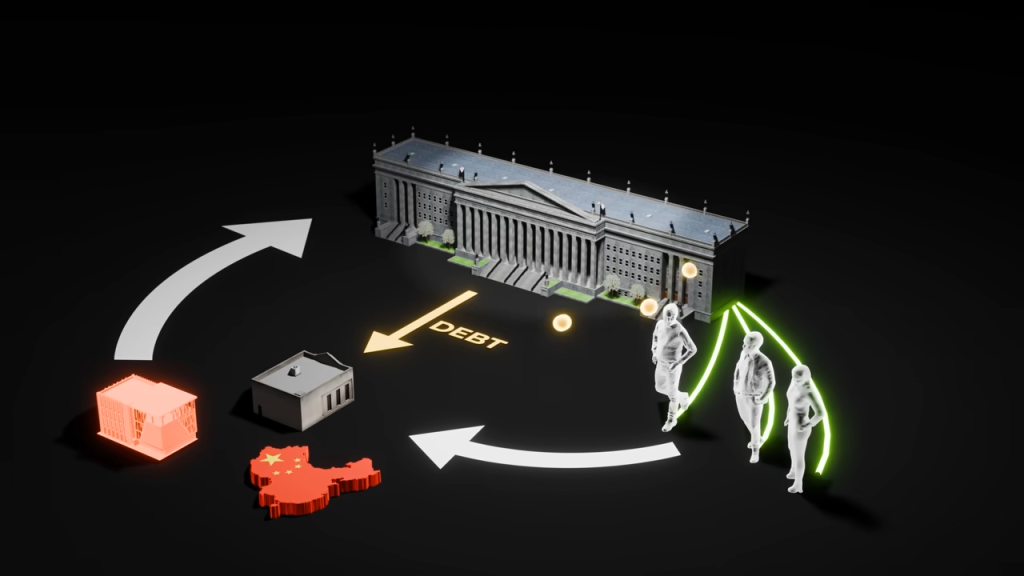

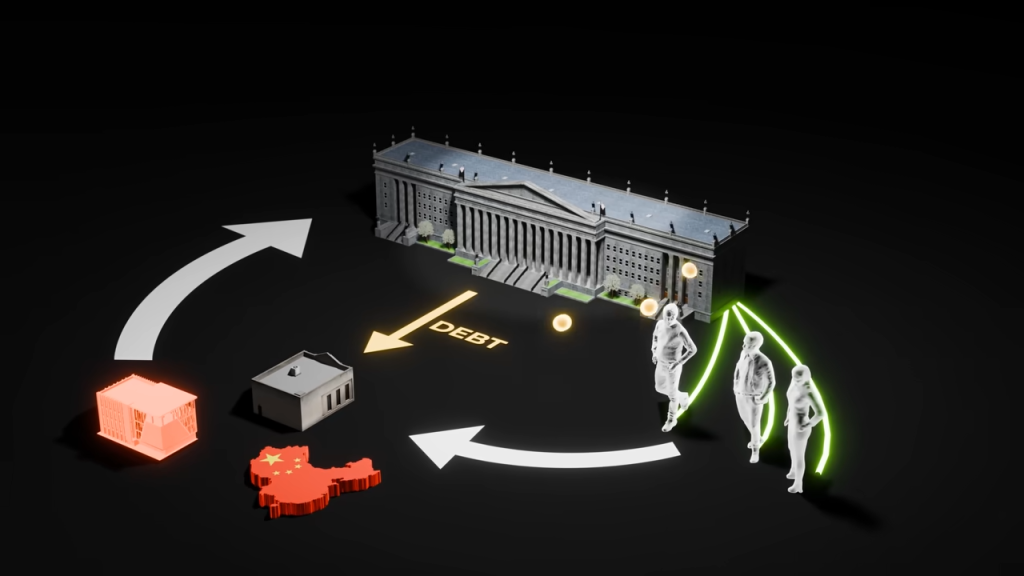

The Role of Central Banks and Government Bonds

Central banks, like the Federal Reserve, regulate money creation by adjusting interest rates, setting reserve requirements, and buying or selling government bonds. When the government needs more money, it issues bonds that banks, corporations, and foreign countries purchase. The money from these sales helps fund government spending, but it also increases national debt, perpetuating the cycle of money creation through borrowing.

Is the System Sustainable?

The current banking system is based on trust. As long as people believe in the stability of financial institutions and continue borrowing and spending, the economy functions smoothly. However, economic crashes, recessions, and financial crises reveal the vulnerabilities of this model.

Final Thoughts

Money may seem like a fixed entity, but in reality, it is a fluid and ever-expanding system shaped by loans, banking policies, and economic forces. Understanding how banks create money helps us navigate the financial world more wisely, making informed decisions about savings, investments, and debt management.

As the digital economy evolves, new technologies like cryptocurrency and decentralized finance (DeFi) may challenge traditional banking models. Until then, the magical creation of money remains at the heart of modern economies, for better or for worse.