Credit cards have become an essential part of modern financial life, promising convenience, rewards, and even free travel perks. But while they offer benefits to consumers, the business behind credit cards is far from generous. From high-interest rates to interchange fees, credit card companies have mastered the art of making money from every transaction. Let’s break down the surprising ways credit cards generate billions annually.

The Illusion of Free Money

For many people, getting a credit card is surprisingly easy. With just a few clicks, an 18-year-old with no job or credit history can access a line of credit worth thousands of dollars. If they use their card responsibly—paying off the balance every month—they can earn significant rewards: cashback, free flights, and even perks like free streaming services.

For financially savvy individuals, it seems like a win-win. By using credit cards for daily expenses and paying off the balance on time, they avoid interest charges while accumulating valuable rewards. But if credit card companies were losing money on these responsible customers, they wouldn’t offer such enticing benefits. So, who’s paying for all these perks?

The Interest Trap

A significant portion of credit card revenue comes from interest charges. With average rates around 20%, cardholders who carry a balance quickly find themselves paying far more than they initially borrowed. Banks and card issuers rely on these customers—those who fall behind on payments—to generate billions in revenue.

However, relying solely on interest charges isn’t the most lucrative business model. Not everyone falls into debt, and many credit card users are financially disciplined. So, credit card companies have found a way to make money from every single transaction, regardless of whether a customer carries a balance or not.

The Secret Sauce: Interchange Fees

Every time you swipe your credit card, multiple financial institutions take a cut before the merchant receives the payment. These cuts—known as interchange fees—are the true moneymakers for credit card companies.

Here’s how it works:

- When you buy an item, your credit card company charges the merchant a fee, usually around 2-3% of the transaction amount.

- That fee is split between your bank, the merchant’s bank, and the payment network (Visa, Mastercard, etc.).

- Even if you pay your balance in full, your card issuer still profits from interchange fees.

For major credit card networks, interchange fees account for billions in revenue every year. Companies like Visa and Mastercard make money whether a cardholder carries a balance or not.

The Rewards Arms Race

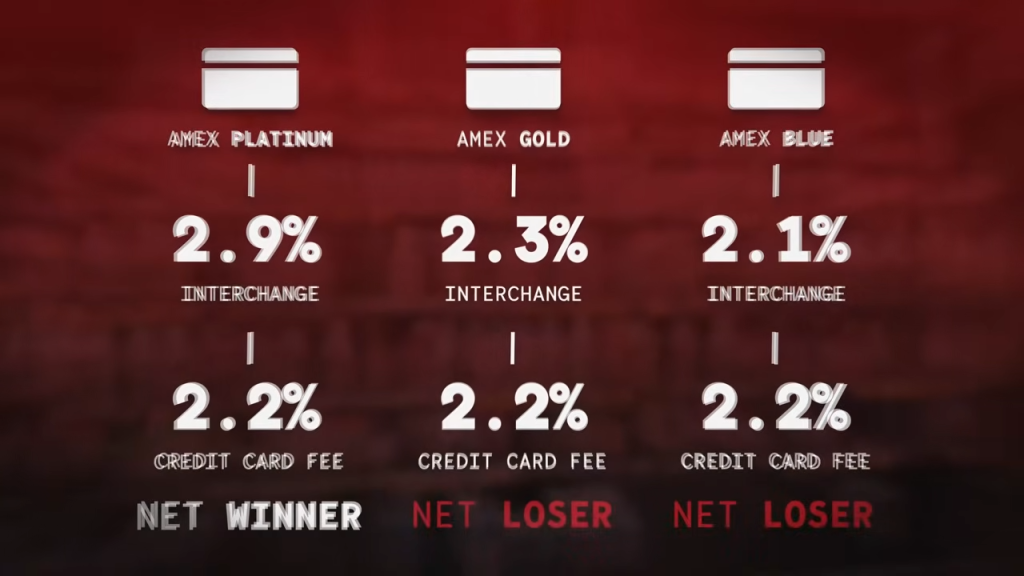

In an attempt to attract wealthy, high-spending customers, credit card issuers have launched an arms race in luxury rewards. American Express, for example, charges merchants higher interchange fees in exchange for access to their affluent customer base.

These customers spend more on travel, dining, and luxury purchases, generating more fees for credit card companies. High-end cards, such as the American Express Platinum or Chase Sapphire Reserve, charge annual fees upwards of $500, yet still attract millions of users because of their exclusive perks.

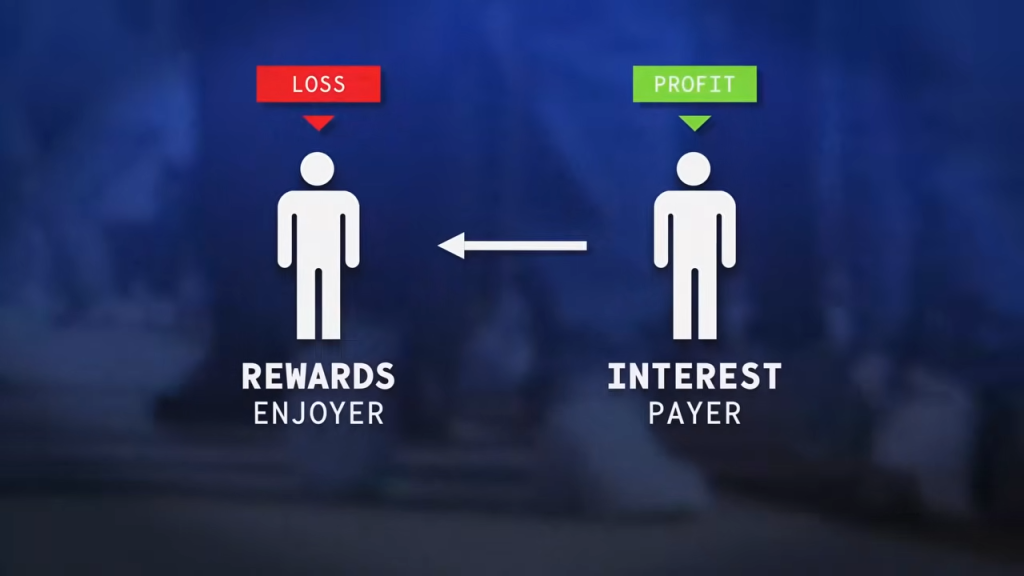

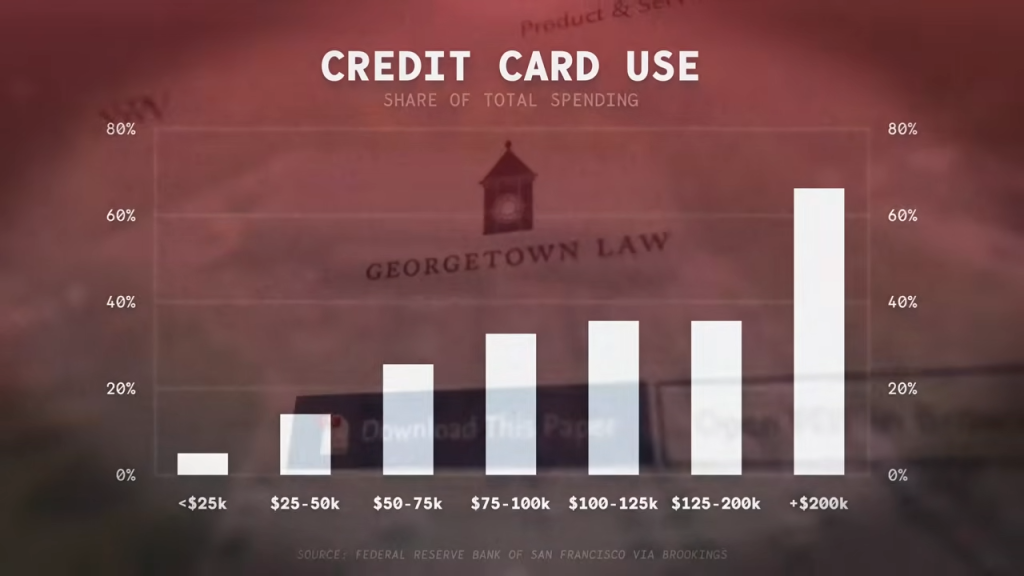

Who Pays for Credit Card Rewards?

While responsible credit card users enjoy cashback and free travel, someone has to foot the bill. In reality, rewards programs indirectly transfer wealth from lower-income individuals to higher-income ones:

- Merchants increase prices slightly to offset interchange fees, meaning everyone—whether they use credit cards or not—pays higher prices.

- Since lower-income individuals are more likely to use cash or debit, they don’t receive any of the cashback or rewards benefits.

- In effect, those who rely on cash end up subsidizing the perks enjoyed by credit card users.

According to the Federal Reserve, cash users effectively lose about $149 per year due to inflated prices, while credit card users gain an average of $1,133 in benefits.

Regulating the System

Countries outside the U.S. have taken steps to limit interchange fees. The European Union, for instance, capped credit card interchange fees at 0.3% in 2015, significantly reducing the profitability of rewards programs. As a result, European credit card users don’t receive the same level of perks as Americans.

In the U.S., debit card interchange fees were capped in 2010, but credit card fees remain unregulated. Until that changes, the cycle of high fees, high rewards, and hidden costs will continue.

Final Thoughts

Credit cards are a powerful financial tool when used responsibly. However, the business model behind them ensures that issuers profit no matter how customers use their cards. From interchange fees to interest charges, credit card companies have found a way to make money at every step.

Next time you swipe your card for cashback rewards, remember: the house always wins. Understanding the mechanics of credit card fees and rewards can help consumers make more informed financial decisions and avoid falling into the traps designed by the industry.