A New Era in Personal Finance

Over the last two decades, technology has reshaped virtually every aspect of our lives—from the way we shop and communicate to how we work and even how we invest. With the advent of real-time data, algorithmic tools, and retail trading platforms, the average investor now has access to information and resources that were once reserved for hedge funds and institutions.

In this article, we explore how technology—especially automation and artificial intelligence—is changing the way we invest. From companies like Tesla leading the charge in innovation, to the rise of trading AI that analyzes markets in milliseconds, we’re entering a new chapter of financial empowerment.

The Democratization of Investing

The Shift From Wall Street to Main Street

Once upon a time, investing required a financial advisor, a hefty sum of capital, and often, a significant level of expertise. That has changed dramatically. Today, millions of people are actively investing through apps and platforms that require no minimum investment and charge zero commissions.

Technology has leveled the playing field. Online platforms now allow individual investors to access the same tools professionals use—charts, indicators, financial models, and even predictive analytics powered by machine learning.

Data at Your Fingertips

Information is no longer hidden behind paywalls or inside brokerages. Real-time news alerts, economic indicators, earnings reports, and global market trends are now freely available to anyone with a smartphone. This accessibility gives investors more confidence and control over their financial decisions.

Why Tesla Represents More Than Just a Stock

Innovation as an Investment Strategy

Tesla is more than a car company—it’s a symbol of future-focused investment. From electric vehicles and solar panels to battery technology and autonomous driving, Tesla has become a favorite among both retail and institutional investors for one reason: growth through innovation.

Investing in Tesla is not just about quarterly earnings. It’s about believing in a long-term vision. Many seasoned investors see Tesla as a way to participate in broader trends like sustainability, clean energy, and automation.

Volatility Creates Opportunity

Tesla is also one of the most traded and volatile stocks on the market. This volatility, while intimidating to some, is a goldmine for active traders. With wide price swings and high volume, Tesla attracts everyone from day traders to long-term holders.

Paired with smart automation tools and trading AI, Tesla becomes not just a company to invest in—but a case study in how tech-savvy investors can navigate fast-moving markets.

How Trading AI Is Transforming the Market

From Human Instinct to Machine Learning

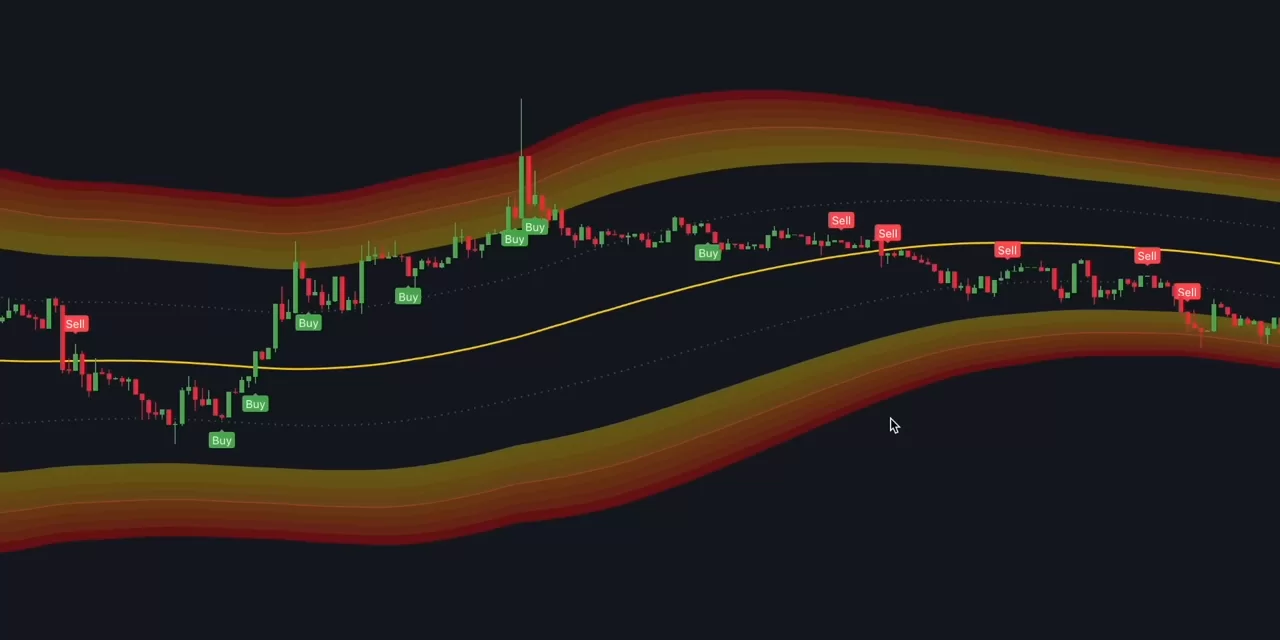

Traditional investing relied heavily on human emotion, instinct, and experience. But human decision-making is often biased and inconsistent. Enter trading AI—sophisticated systems trained to identify patterns, optimize timing, and eliminate emotional decision-making.

These tools are capable of analyzing thousands of variables in real-time:

- Price momentum

- Historical volatility

- Sentiment analysis from financial news and social media

- Macro-economic indicators

The result is faster, more accurate, and more consistent decision-making. AI doesn’t sleep, doesn’t get tired, and doesn’t panic in a market sell-off.

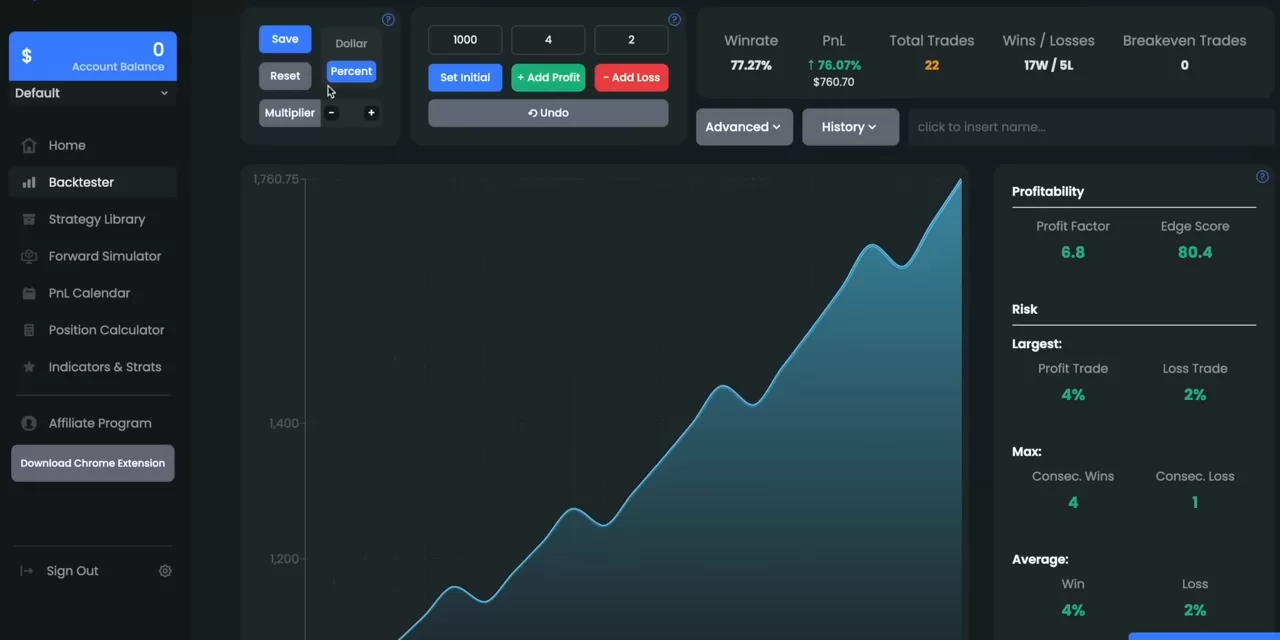

Algorithms That Adapt

Modern AI trading systems don’t rely on static rules. They learn and adapt as markets evolve. If an economic indicator loses its predictive power, AI models can adjust accordingly. This dynamic nature makes trading AI a powerful ally for both novice and experienced investors.

The Rise of Passive AI Portfolios

Smarter Diversification

One of the most compelling uses of AI in investing is portfolio management. AI can automatically diversify assets based on your goals, risk tolerance, and time horizon. It can rebalance portfolios monthly or even daily based on market trends—without you lifting a finger.

This means you no longer need to guess which sector will perform best. AI monitors your investments and makes adjustments to reduce risk and maximize return.

Personalized Risk Management

Imagine a system that understands your financial goals as deeply as you do—and acts accordingly. That’s exactly what modern AI-driven platforms are aiming for. They can warn you of overexposure, suggest lower-risk alternatives, or even pause investments in volatile conditions.

This level of personalization was unthinkable a decade ago. Today, it’s accessible with just a few taps.

Emotional Discipline Through Automation

Removing Human Error

Many losses in investing come from human error—selling too early, buying too high, or chasing trends. Automated trading reduces these mistakes. Once you set the rules, the system sticks to them, even when your emotions tell you otherwise.

Whether it’s Tesla stock reaching a new high or the market dipping unexpectedly, AI systems follow logic, not fear.

Time Savings and Peace of Mind

For many investors, time is a limiting factor. Between work, family, and other responsibilities, monitoring charts and financial news isn’t realistic. AI-based platforms allow you to stay invested without constant supervision.

Automation also reduces stress. Knowing that a system is monitoring your assets and executing smart decisions offers peace of mind—a priceless benefit for busy professionals.

What This Means for Investors Over 35

If you’re in your mid-thirties or beyond, you’re likely thinking not just about wealth creation, but also about stability and future security. Here’s how tech-driven investing meets those needs:

- Reduced Complexity: You don’t need to be a market expert. Let AI simplify the process.

- Customizable Portfolios: Match your financial goals with a tailored investment strategy.

- Long-Term Focus: Use automation to stay disciplined and avoid short-term distractions.

- More Control: Monitor and adjust your investments in real-time if needed.

The takeaway? Even if you’ve never invested in tech stocks or used algorithmic tools, you don’t need to be left behind. The learning curve is shorter than ever, and support systems are built with accessibility in mind.

Risks and Responsible Use

Know the Limits of AI

No system is perfect. AI still operates on historical data and statistical models. It cannot predict black swan events like pandemics or political upheaval with certainty. Investors should treat AI as a tool, not a guarantee.

It’s also important to understand the underlying logic of the AI platform you use. Look for transparency, performance data, and independent reviews before committing.

Combine with Human Judgment

The best investors don’t outsource everything to machines. Instead, they combine human intuition with machine precision. Use AI for routine decisions and technical analysis, but keep your long-term goals and personal values in mind.

Conclusion: Investing Smarter, Not Harder

We live in an era where technology has made smart investing more accessible, more efficient, and more personalized than ever before. Whether you’re inspired by the innovation behind Tesla or curious about how trading AI can optimize your strategy, the tools are available—and they’re getting better by the day.

For investors aged 35 and above, this is an opportunity to balance ambition with responsibility. To take advantage of tech without abandoning caution. To embrace the future of investing on your own terms.

Because the smartest investment you can make today… is learning how to invest smartly for tomorrow.