Ever wondered why $1 isn’t equal to 1 Euro, 1 Yen, or 1 Dong? Currencies vary in value, and exchange rates change constantly, but why? Let’s break it down in simple terms.

A Short History of Money 💰

For centuries, money was directly linked to gold, known as the gold standard. A country’s currency was backed by a fixed amount of gold, making exchange rates stable. However, as economies expanded, this system became impractical. By the 1970s, most countries shifted to fiat money—currency that has value simply because people trust it. Today, supply and demand, economic stability, and trade influence how much a currency is worth.

Key Factors That Determine Currency Value 📉📈

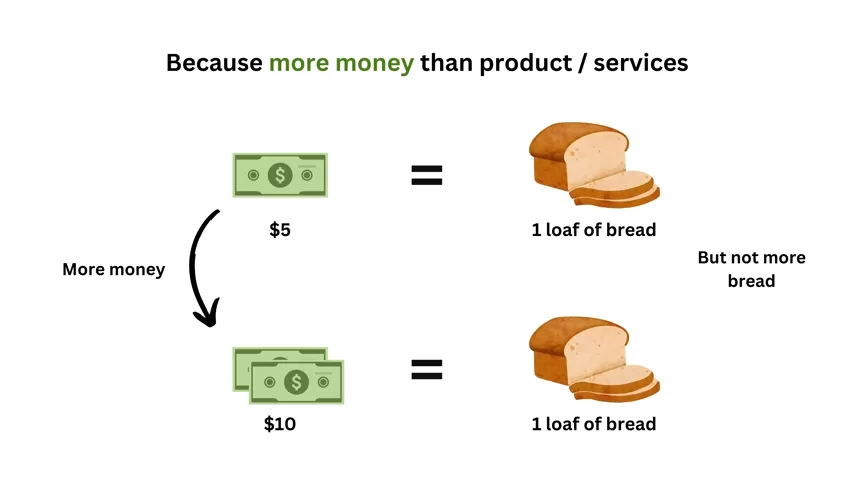

1. Inflation 🔥

Inflation happens when prices rise and the purchasing power of money falls. Countries with high inflation see their currency lose value. A famous example is Zimbabwe, where hyperinflation caused its dollar to become almost worthless. In contrast, stable economies like the U.S. and Switzerland maintain low inflation, keeping their currencies strong.

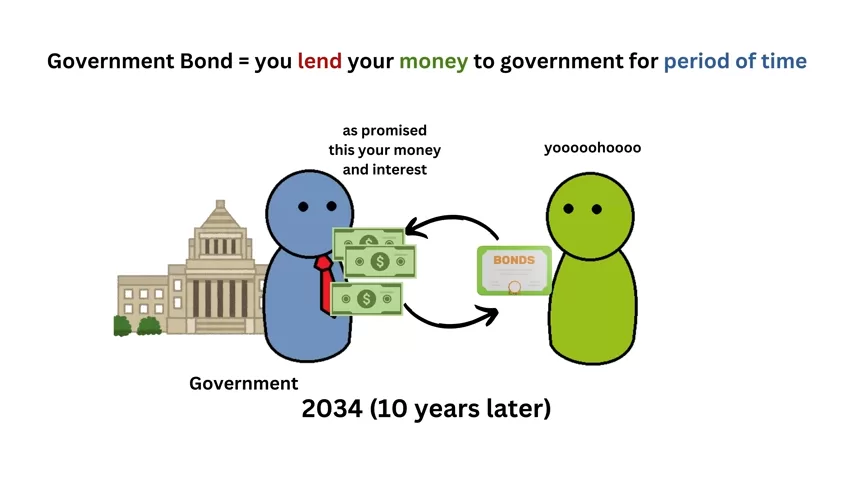

2. Interest Rates 📊

Central banks set interest rates, which affect currency demand. Higher interest rates attract foreign investors, increasing demand for the currency and strengthening it. If U.S. interest rates rise while Japan’s stay low, investors sell Yen to buy U.S. dollars, increasing the dollar’s value.

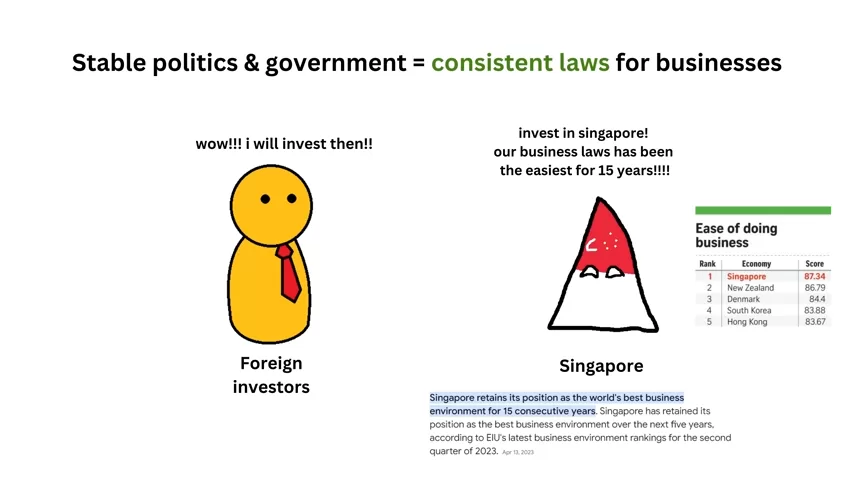

3. Political & Economic Stability ⚖️

Countries with stable governments and strong economies have more valuable currencies. For example, when China opened its economy in the 1970s, foreign investments flooded in, strengthening the Chinese Yuan. On the other hand, political turmoil in Venezuela has drastically weakened its currency.

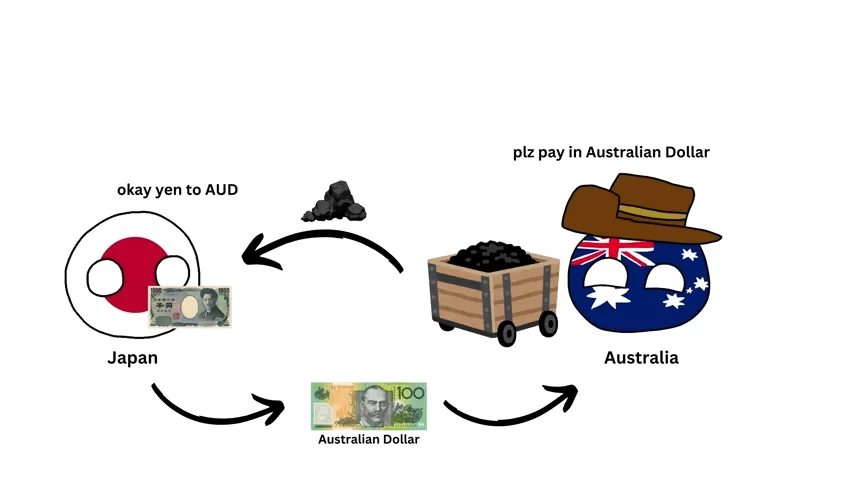

4. Imports & Exports (Trade Balance) 🚢

If a country exports more than it imports, demand for its currency increases. Japan exports cars worldwide, so other countries need Japanese Yen to buy them, strengthening its value. Conversely, if a country imports more than it exports, its currency weakens.

5. Fixed Exchange Rates 🔗

Some countries peg their currency to another, meaning their value remains fixed. For example:

- Brunei’s Dollar is pegged 1:1 to the Singapore Dollar, ensuring stability.

- Belize fixes its currency at 2 Belize Dollars = 1 U.S. Dollar to maintain economic confidence. However, this makes them highly dependent on the stronger country’s economy.

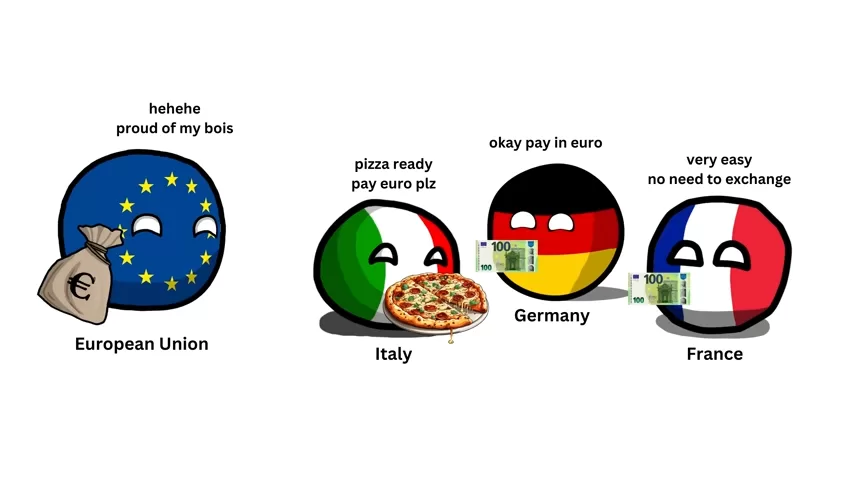

Why Don’t All Countries Use the Same Currency? 🌍

A single global currency sounds convenient, but it’s unrealistic. The Euro is an example—while it simplifies trade within Europe, countries must sacrifice control over their own monetary policies. When Greece faced an economic crisis, it affected the entire Eurozone. Now imagine if the whole world used one currency—a crisis in one country would spread globally.

Should We Make Currencies as Strong as Possible? 💪💵

Not necessarily! A strong currency makes imports cheaper but exports more expensive, which can hurt countries that rely on exports (e.g., China). Meanwhile, a weaker currency helps exports but makes imported goods costlier. Governments adjust currency policies based on their economic goals.

Final Thoughts 🎯

The value of money isn’t set in stone—it depends on inflation, interest rates, economic stability, trade, and policies. Understanding these factors helps us see why exchange rates fluctuate and why some currencies are stronger than others.

Got more questions about how money works? Let us know in the comments!